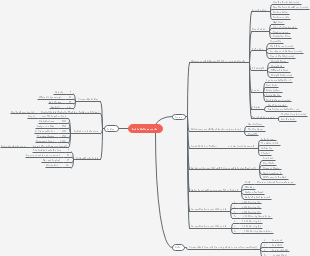

MindMap Gallery Mind map on Tax Incentives in Budget 2021

Mind map on Tax Incentives in Budget 2021

This mindmap is about the tax incentives proposed in Budget 2021.

Edited at 2021-03-24 11:14:10Mind map on Tax Incentives in Budget 2021

- Recommended to you

- Outline