Understanding the Balance Sheet with Mind Maps

Balance sheets are one of the most important business documents that help us understand the health of a business. We'll explore its application and contents and use mind maps to make the whole process simple and easy to understand.

Introduction:

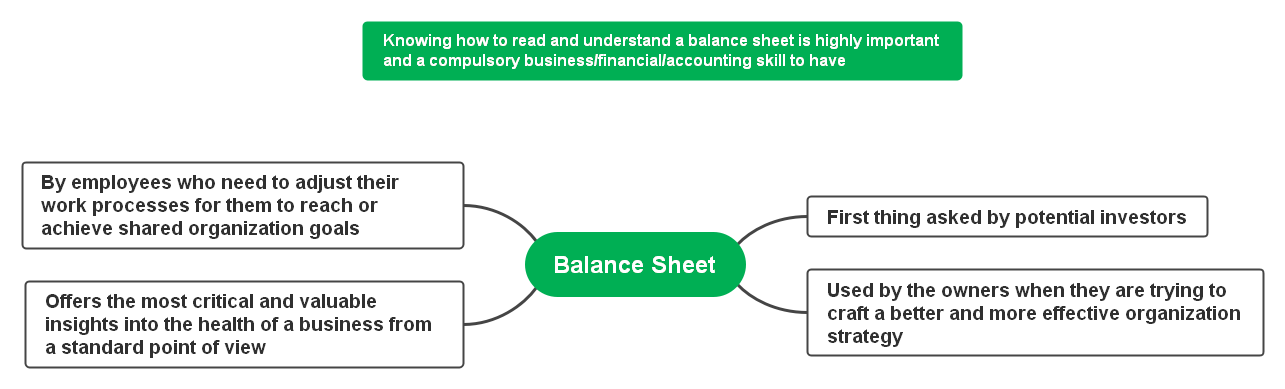

A balance sheet is the most important financial document for any business as it offers the most critical and valuable insights into the health of a business from a standard point of view. If a potential investor wishes to invest in the company, the first thing they will ask the company would be its balance sheet at present. Other than potential investors, it is used by the owners when they are trying to craft a better and more effective organizational strategy or even by employees who need to adjust their work processes for them to reach or achieve shared organizational goals.

So, from the point of view of all three (investor, owner, employee), knowing how to read and understand a balance sheet is highly important and a compulsory business/financial/accounting skill to have. In this article, we will elaborate on what a business sheet stands for, how to read the information it contains, and understand the way it functions. To make matters even simpler and easier to understand as well as memorize, we will be employing mind maps. As mind maps are proven to be an effective method to simplify complex concepts, they are even used at the corporate level for effective organization of visual information.

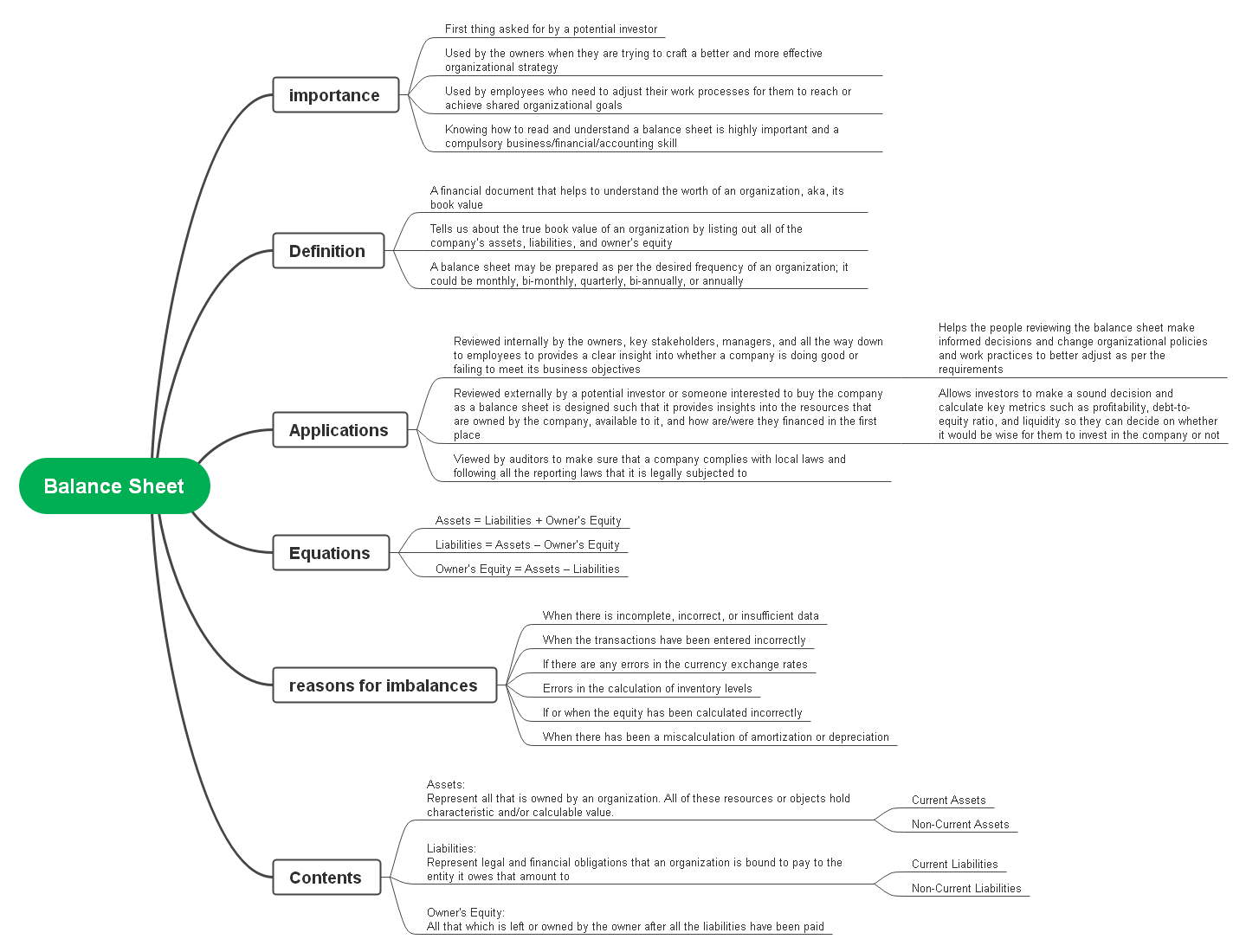

Definition of a Balance Sheet:

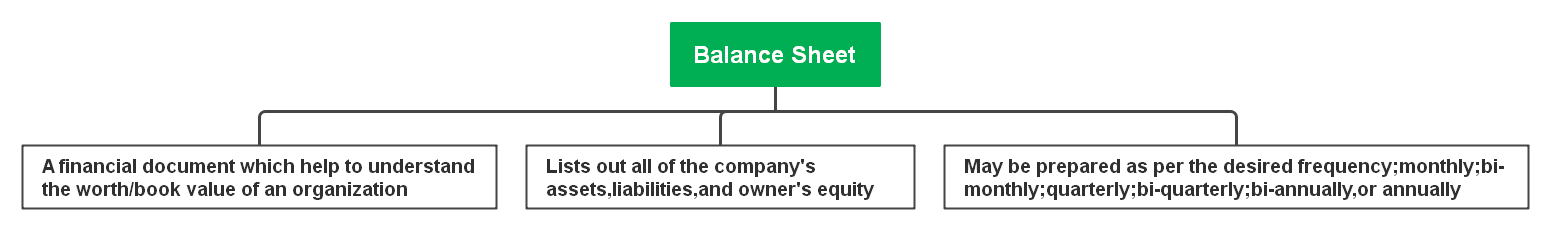

A balance sheet is a financial document that helps to understand the worth of an organization, aka, its book value. Although some may argue that why do we need an entire sheet for that purpose when a simple figure can do that for us, but there would be a lot of information missing, and this is where a balance sheet comes in.

A balance sheet tells us about the true book value of an organization by listing out all of the company's assets, liabilities, and owner's equity, which can all be tallied up to discover the true book worth of an organization.

Depending upon the preference of the organization, a balance sheet may be prepared as per the desired frequency of an organization; it could be monthly, bi-monthly, quarterly, bi-annually, or annually or as dictated by the law of the company.

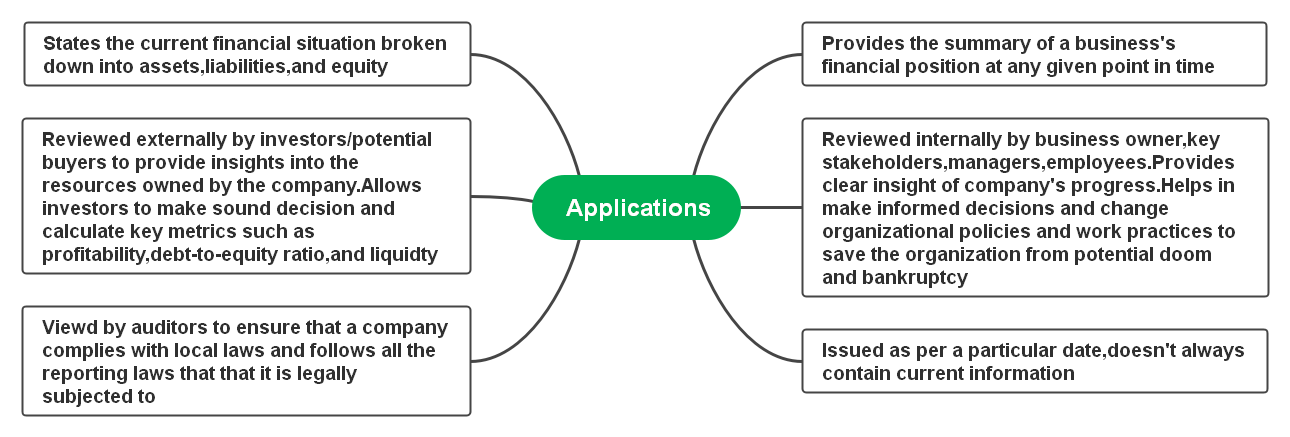

Application:

A balance sheet can provide a summary of a business's financial position at any given point in time. Though it states the current financial situation broken down into assets, liabilities, and equity, it still serves a few very different functions that depend upon the type of people viewing the document.

- The first type is when the balance sheet is being reviewed internally. This includes business owners, key stakeholders, managers, and all the way down to employees. It provides a clear insight into whether a company is doing good or failing to meet its business objectives. This helps the people reviewing the balance sheet make informed decisions and change organizational policies and work practices to better adjust as per the requirements. This allows organizations to pivot towards new and better opportunities and even double down on their success, or make changes to save the organization from potential doom and bankruptcy.

- The second type is when the balance sheet is reviewed externally by a potential investor or someone interested to buy the company as a balance sheet is designed such that it provides insights into the resources that are owned by the company, available to it, and how are/were they financed in the first place. This allows investors to make a sound decision and calculate key metrics such as profitability, debt-to-equity ratio, and liquidity so they can decide on whether it would be wise for them to invest in the company or not.

- There is a third type where the balance sheet is viewed by auditors. Auditors make sure that a company complies with local laws and following all the reporting laws that it is legally subjected to.

Since the balance sheet is issued as per a particular date, it doesn't always contain current information; however, the information it does contain may be labeled up-to-date by the organization it is being issued by. Stakeholders and investors use this information to make a prediction on how well the company may perform in the future.

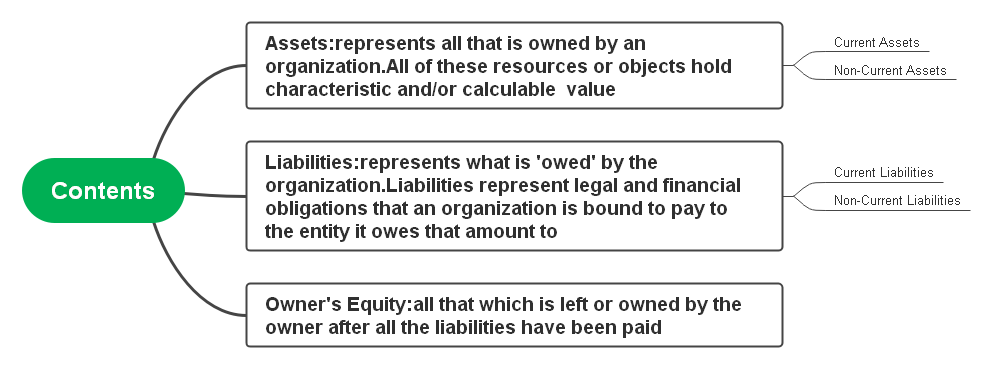

Contents of a Balance Sheet:

There are three main contents of a balance sheet naming assets, liabilities, and owner's equity. Let's explore each one in detail and determine what they represent.

1. Assets:

Assets in a balance sheet represent all that is owned by an organization. All of these resources or objects hold characteristic and/or calculable value. A business is in the position to convert its assets into cash through a process known as liquidation if it wants. There are two subcategories of assets:

- Current Assets: Current assets are objects, items, or possessions that a company is capable of liquidating in a year or less. This includes the company's inventory, accounts receivable, marketable securities, cash equivalents or cash itself, or prepaid expenses.

- Noncurrent Assets: Noncurrent assets are objects, items, or possessions that are long-term investments and not easily or quickly liquefiable. This includes trademarks, land, patents, goodwill, brands, equipment, or machinery used for the manufacturing of goods or for performing the organization's services and intellectual property.

Assets are tallied with a '+' is the balance sheet.

2. Liabilities:

Liabilities are the direct opposite of assets. As assets represent what is owned by the organization, liabilities represent what is 'owed' by the organization. Liabilities represent legal and financial obligations that an organization is bound to pay to the entity it owes that amount to. There are also two subcategories of liabilities.

- Current Liabilities: Current Liabilities are liabilities that are/may be due to be paid within a period of a year or so. Examples include accounts payable, payroll expenses, debt financing, rent payment, utility payments, and other accrued expenses.

- Noncurrent Liabilities: Noncurrent liabilities are the payables that are not due in a year and represent long-term obligations such as loans, leases, deferred tax liabilities, bonds payable, and pension provision.

3. Owner's Equity:

Owner's equity is all that which is left or owned by the owner after all the liabilities have been paid. It is also called shareholder's equity; this is what is truly owned by the owner or the shareholders with no obligations attached. In a sense, there are two key elements that are a part of equity.

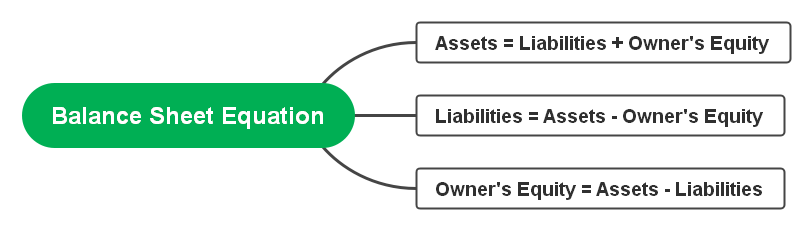

Balance Sheet Equation:

Though there are a lot of figures and numeric data present in a balance sheet, almost in all cases, the information will be organized according to the following Equation:

Assets = Liabilities + Owner’s EquityAlthough this is the default format on which most balance sheets are organized, it is still not the only way of doing so. As we can modify the given equation, we can also modify the arrangement of the contents of a balance sheet as per preference or intended purpose.

Two other formats include:

- Liabilities = Assets – Owner's Equity.

- Owner's Equity = Assets – Liabilities.

The most important aspect of the balance sheet is that it should always remain balanced, hence the name. Taking the default equation, the sum of liabilities and owner's equity must always be equal to the total assets of the company. In a similar manner, the liabilities must be equal to the difference of assets owned by the organization and the owner's equity, and owner's equity must always be equal to the difference of the assets owned by the organization and the liabilities.

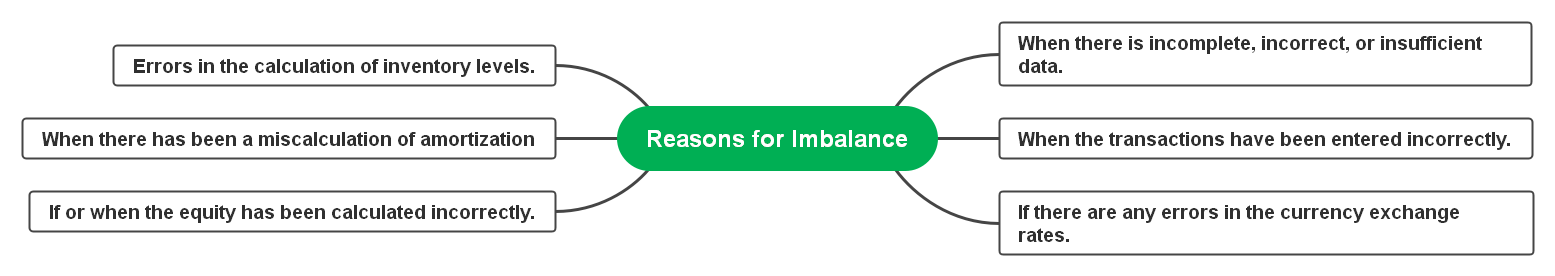

In case both sides are not balanced, it is quite likely that there has been some mistake. Some of the main reasons these errors occur are:

- When there is incomplete, incorrect, or insufficient data.

- When the transactions have been entered incorrectly.

- If there are any errors in the currency exchange rates.

- Errors in the calculation of inventory levels.

- If or when the equity has been calculated incorrectly.

- When there has been a miscalculation of amortization (a technique in accounting that is used to lower the book value of an intangible asset or loan periodically over a set period of time) or depreciation (a method used in accounting to determine the cost of a tangible asset over its life expectancy).

Example:

To better understand how exactly a balance sheet looks like and how it appears balanced, consider the example given below:

| Assets | Liabilities | Owner's Equity | ||

| Current | Noncurrent | Current | Noncurrent | - |

| $14,800 | $23,200 | $10,500 | $7000 | $20,500 |

| - | Total = $17,500 | $20,500 | ||

| Total = $38,000 | Total = $38,000 | |||

The above is a classic example of what a simple balance sheet will look like. Though it is missing a lot of intrinsic elements that we had discussed above, it still serves the intended purpose. We can see that the company's total assets tally up to $38000 on the left-hand side whereas the liabilities total up to $17,5000 along with $20,000 worth of owner's equity, both of which add up to the same $38,000 on the right-hand side.

The Importance of Balance Sheet:

No denying that the balance sheet is the most important business document that provides us a clear insight of what the business has been up to, how it has been performing, and what is its current state; whether the company is thriving or struggling to maintain its existence. The information found in the balance sheet is of utmost significance for not just the business owner, but also the stakeholders, employees, investors, and regulators. This makes it crystal clear that knowing how to read a balance sheet and understanding what it stands for and what its contents are is paramount.

In essence, the mindmap below completely illustrates what a balance sheet truly stands for:

Conclusion:

Reading a balance sheet is not as hard as it has been rumored to be. Depending on the company practices and its level of indulgences, as well as division in the assets, liabilities, and owner or stakeholder equity, a balance sheet may appear to be visually complex. Still, all you need to do is work your way through the numbers and it should all sum up as per the equation.

We hope that the mind map diagrams made it easier to grasp the technical aspects of this difficult topic. There are limitless applications to how a mind map can be useful in various contexts. There are no limitations for it to be used only for business purposes as it can be employed in all aspects of everyday life. MindMaster is a powerful and versatile application to draw mind maps easily and quickly. Ranging from simple to highly complex mind maps, the app provides a number of styles to draw mind maps as per your preference, making it easier to learn and process complex information on a whim.